However restaurants as part of hotels with room tariffs exceeding Rs. Value-added tax or GST goods and services tax will be applied to Vimeo membership purchases made in the following countries.

Goods and Services Tax GST is an indirect tax.

. An indirect tax such as sales tax per unit tax value added tax VAT or goods and services tax GST excise consumption tax tariff is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively if the entity who pays taxes to the tax collecting authority. Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021.

Taxable and non-taxable sales. Doing business in Malaysia 2022. John can also claim an amount that reflects the decline in value of the photocopier on his tax return.

Segala maklumat sedia ada adalah untuk rujukan sahaja. Present your unique QR-code in Tourego App to the cashier for tax refund during payment. In other countries GST is known as the Value-Added Tax or VAT.

Report all rental income on your tax return and deduct the associated expenses from your rental income. 462017-Central Tax Rate dated 14th November 2017 standalone restaurants will charge only 5 GST but cannot enjoy any ITC on the inputs. And be within 15m.

20212022 Malaysian Tax Booklet. Digital streaming. The seller is registered for GST and charges John 1100 including 100 GST.

It lists mailing addresses phone numbers and hours of telephone service of the offices. GSTR 20131 Goods and services tax. In order for the tax refund to work via mobile app please ensure that you have turned on your location service and notification alert on your mobile phone.

Each e-way bill has to be matched with a GST invoice. Within the United States rates currently range from 4 to 11. This is because the tax invoice not only enables the seller to collect payments but also avail input tax credit under GST regime.

Get complete Code to calculate Income Tax Liability of Individual Tax payers in India for AY 2021-22. VAT Value Added Tax Calculator. To make things more complex some locations tax certain things while others dont eg- p hysical goods vs.

GST and Sale Price by adding reducing the amount of GST. 122017 Central Tax dated 28 th June 2017 and notification no. Have your tax refund status tracked while you are on the go.

7500 still continue to. Corporate Sustainability Diversity and Inclusion Hall of fame Our leadership team Press releases PwC in the news Third Party Code of Conduct Transparency Report Contact us. All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income.

Zip code and GSTIN. Goods and Services Tax the name for the value-added tax in several jurisdictions. Goods and Services Tax Malaysia Goods and Services Tax Singapore Notes.

Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017. The goods and services tax GST is a value-added tax introduced in Malaysia in 2015 which is collected by the Royal Malaysian Customs Department. Overview of Goods and Services Tax GST in Singapore.

Transporter ID and PIN Code now compulsory from 01-Oct-2018. The reintroduction of the Sales and Services Tax SST has kept corporates across Malaysia busy for the last three months or so. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

Central Goods and Services Act 2017. A GST perspective In the run-up to Budget 2018 our Head of Indirect Tax Raja Kumaran discusses the need for a more resilient and sustainable GST system in Malaysia. Digital downloads vs.

To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or. Rs 25 Total late fees to be paid per day. Many domestically consumed items such as fresh foods water electricity and land public transportation are zero-rated while some supplies such as.

ASCII characters only characters found on a standard US keyboard. Whether your patrons are taxed and at what rate depends on both their location and the types of benefits you are providing in the ir tier. The current GST rate is 7.

Reducing the cost of doing business. If your products are non. From 1 st April 2015 to 31 st May 2018 Malaysia Passenger Service Charge PSC or Airport Tax for domestic and international air travel which is collected on behalf of Malaysia Airport Holdings Berhad or Senai Airport Terminal Services Sdn Bhd was subject to GST at the standard rate of 6.

52017 Integrated Tax dated 28th June 2017 and the same is explained in the below table. Must contain at least 4 different symbols. This excluded flights ex-LBU LGK and TOD as they.

The HSN code required while issuing of a tax invoice based on the annual turnover in the preceding Financial Year has been specified in notification no. Goods and services tax Australia Goods and Services Tax Canada Goods and Services Tax Hong Kong Goods and Services Tax India Goods and Services Tax Malaysia Goods and Services Tax New Zealand Goods and Services Tax Singapore. John can claim a GST credit of 100 on his activity statement.

As per Notification No. The next section in invoice is the Bill to section which contains the details of your customer. Malaysia Malay Mexico Spanish Netherlands Dutch Pakistan Urdu Philippines Filipino.

The sales tax charged for users in the same state may vary based on zip code. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. Dipapar menggunakan Chrome versi terkini dengan paparan 1280 x 800 Hak Cipta Terpelihara 2015Jabatan Kastam Diraja MalaysiaHak terpelihara.

Goods and Services Tax or GST meaning is a broad-based consumption tax levied on the import of goods collected by Singapore Customs as well as nearly all supplies of goods and services in Singapore. 6 to 30 characters long. SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system.

The standard rate is currently set at 6. Canada Revenue Agency CRA Tax Services Offices to contact by non-residents for GSTHST enquiries. If you own rental real estate you should be aware of your federal tax responsibilities.

Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check For GST Registered Company. Tax invoices sets out the information requirements for a tax invoice in more detail. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Name of the Act Late fees for every day of delay. You need to fill in the fields as shown especially the tariff code default tax rate if your products are taxable.

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

Eztax In Easiest Accounting In 8 Countries Accounting Software Accounting Online Accounting

The Art Of Mapping Products With Tax Engine Commodity Codes

Non Deductible Tax Code Bl Sap Blogs

Yyc Advisors Recommended Gst Tax Code Listings For Supply Source Accounting Software Enhancement Towards Gst Compliance Revised As At 18 July 2016 By Customs Facebook

Setting Up Taxes In Woocommerce Woocommerce

Non Deductible Tax Code Bl Sap Blogs

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

11 13 Mar 2016 Lexis Habiscus Awesome Deals Awesome Deal Malaysia

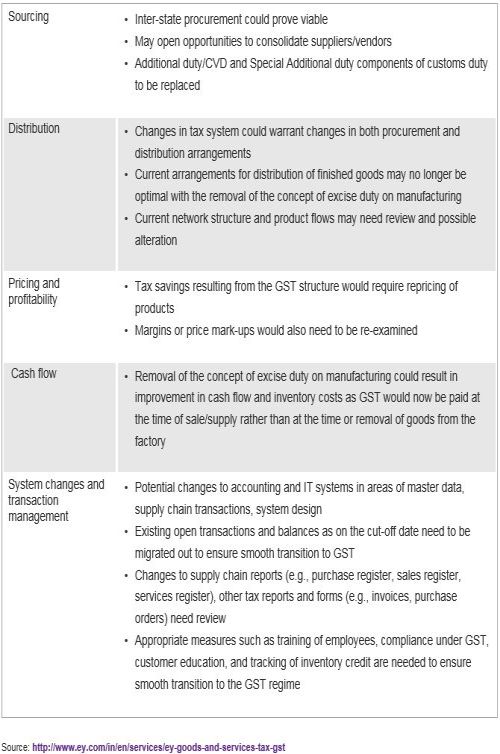

The Introduction Of Gst In India What Businesses Should Look Out For In 2017 Sales Taxes Vat Gst Singapore

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences